Like many online payment platforms, PayPal may place funds in certain situations to help prevent fraud, disputes, and other potential issues. This fund can impact both buyers and sellers using the platform. If you’re a buyer using PayPal for eBay transactions, there might be a hold on funds for a certain period, typically 21 days. Therefore, knowing how to trick paypal into releasing funds is vital.

You can provide proof of establishment as one of the first steps to get PayPal to release funds. Other ways include verifying your identity and responding to disputes promptly. Also, maintaining a clear line of communication with customers helps sellers to get PayPal to release their funds.

It’s important to note that while PayPal’s fund holds are designed to protect buyers and sellers from fraudulent transactions and disputes; they can sometimes be frustrating for users. This article will discuss how to trick paypal into giving you money.

Table of Contents

Understanding PayPal’s Funds Availability

Why PayPal Holds Funds

Here are some of the main reasons why PayPal may place holds on funds:

- Risk Management: PayPal aims to prevent fraudulent activities, unauthorized transactions, and disputes.

- New Accounts or Sellers: New free PayPal accounts or sellers without an established transaction history are often subjected to fund holds.

- Unusual Activity: Sudden increases in sales volume, changes in selling patterns, or transactions that deviate from a seller’s typical behavior might trigger fund holds.

- Dispute Resolution: When a buyer raises a dispute or files a complaint about a transaction, PayPal may hold the funds until the issue is resolved.

- Verification: PayPal might hold funds when they need to verify account information or the account holder’s identity.

Importance of Knowing PayPal’s Policies

Understanding PayPal’s policies is crucial for both buyers and sellers. Here’s why:

- Transparency: Knowing PayPal’s policies regarding how to get paypal money off hold instantly, disputes, refunds, and other aspects of transactions allows you to anticipate potential issues and plan accordingly. Click here to find out if PayPal is safer than credit cards.

- Mitigating Frustration: Understanding the reasons for fund holds can help you manage your expectations and take steps to prevent them.

- Optimizing Sales: Sellers who understand PayPal’s policies can structure their transactions and sales strategies to minimize the likelihood of fund holds.

- Quick Resolutions: If you know the steps to take in case of disputes or holds, you can work towards resolving issues more efficiently.

- Compliance: Failure to comply with their policies could result in account limitations, suspensions, or permanent bans.

Common Reasons for PayPal Money Holds

Here’s an explanation of why my money is on hold on PayPal-

- New to using PayPal for sales: PayPal might place holds on funds for new accounts or accounts with limited transaction history to ensure the legitimacy of the transactions and performance activity.

- Too many disputes: Accounts with frequent conflicts, claims, or chargebacks can trigger fund holds as PayPal investigates the underlying reasons for the disputes.

- Suspicious selling patterns: Rapid increases in sales volume, unusual transaction behavior, or deviations from your everyday selling practices could be seen as suspect and lead to fund holds.

- Selling high-risk items: Transactions involving high-risk items, such as electronics, event tickets, or certain digital goods, might result in fund holds due to the increased potential for disputes.

- PayPal account inactivity: Accounts that have been inactive for some time might experience fund holds when transactions are suddenly initiated. PayPal uses this precaution to prevent unauthorized access.

- Suspected unauthorized users: If PayPal suspects that your account has been compromised or accessed by unauthorized individuals, they might place funds to prevent further fraudulent activity.

- Regulatory requirement problems: If regulatory or legal issues are associated with your account or transactions, PayPal could hold funds until the situation is resolved to ensure compliance.

It’s important to note that while these are common reasons for PayPal fund holds, they are not exhaustive, and PayPal’s policies and practices may evolve. To avoid or address funds, users should follow PayPal’s guidelines, maintain a positive transaction history, provide accurate information, and promptly address any issues or disputes.

How to Get PayPal to Release Funds

Here is how to trick paypal into releasing funds:

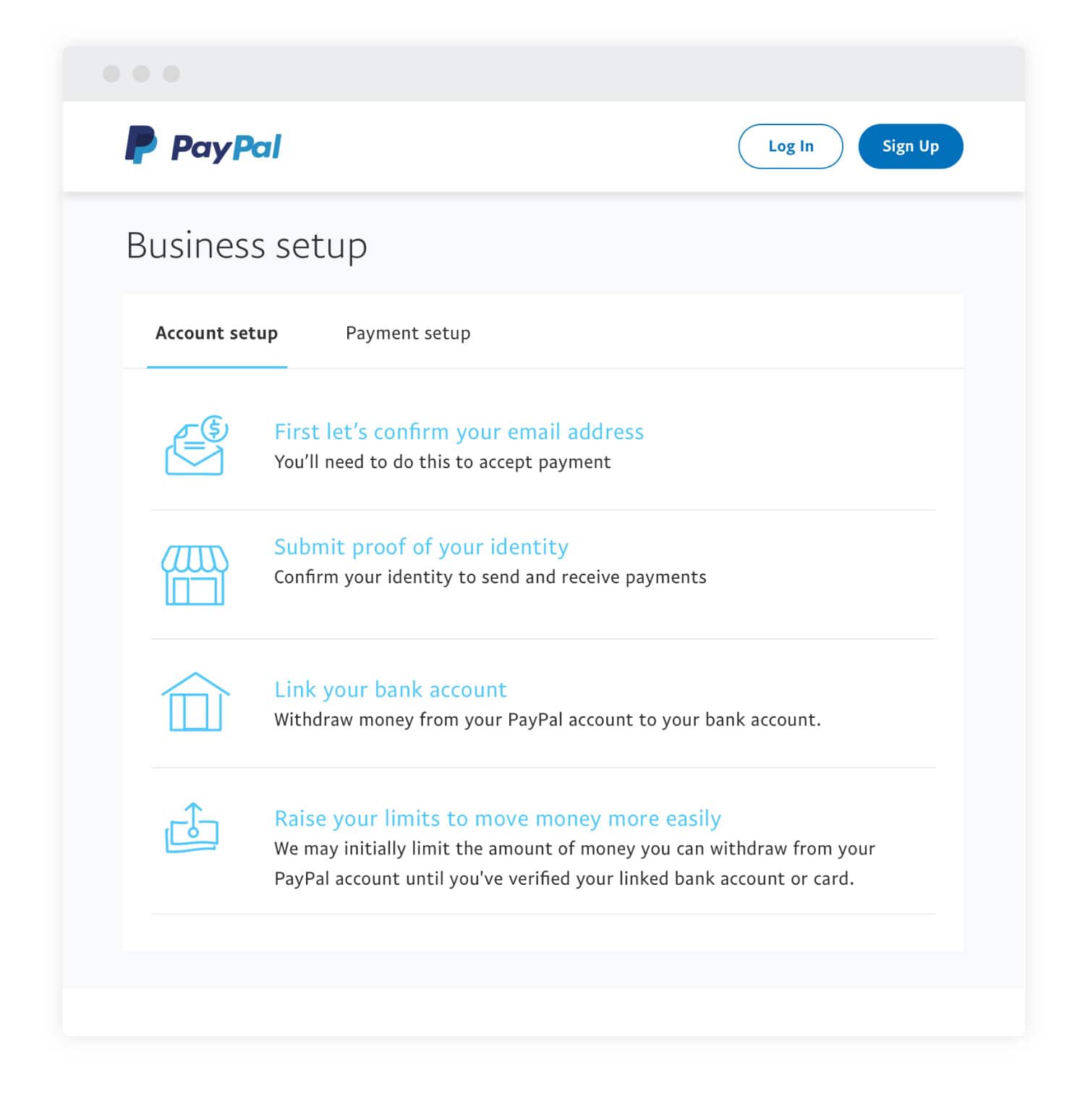

Providing Proof of Establishment

If you’re a new seller with limited transaction history, PayPal might hold funds as a precaution. To demonstrate your legitimacy:

- Provide information about your business or personal identity.

- Upload relevant documents that establish your business, such as business licenses or tax IDs.

- Ensure that your account information matches the details you provide during transactions.

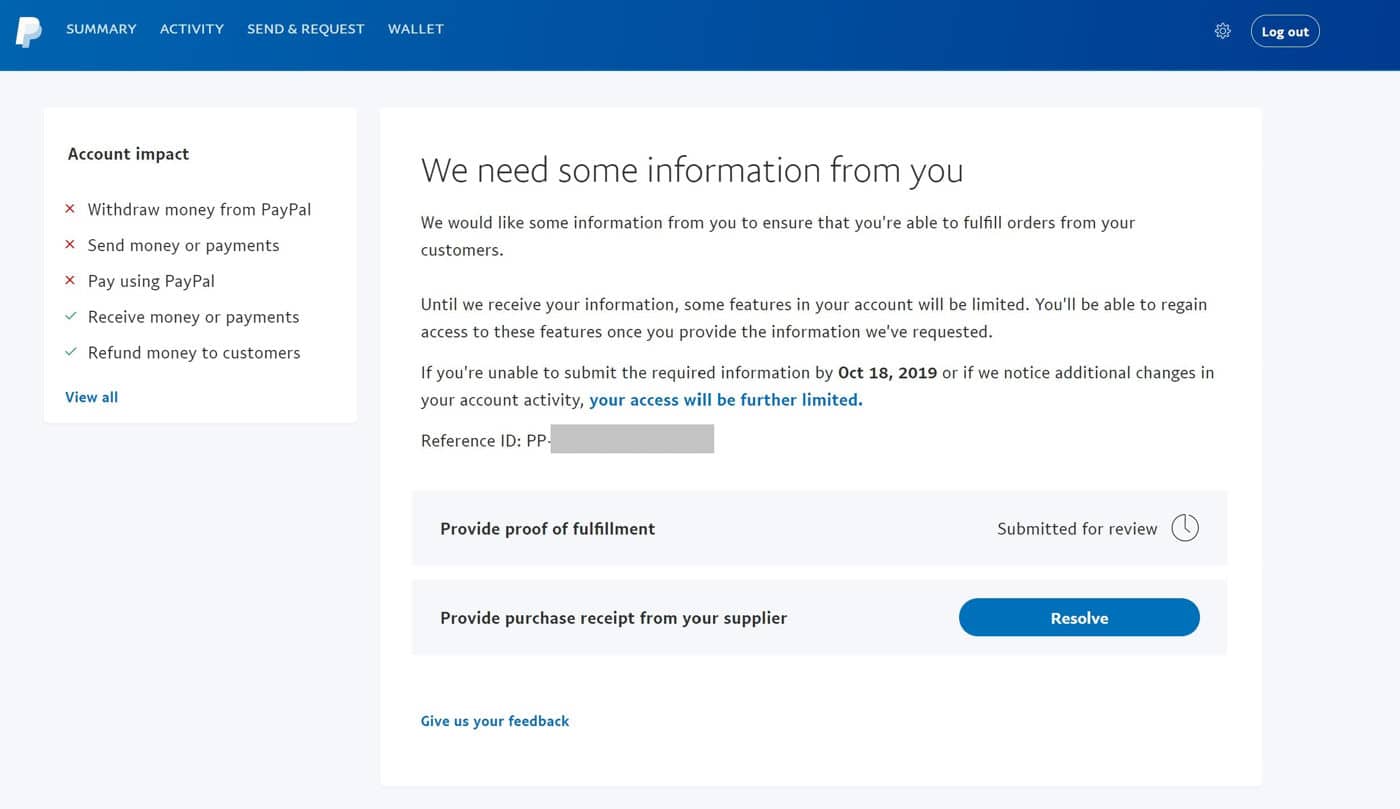

Verifying Your Identity

PayPal may require identity verification to release funds:

- Confirm your email, phone number, and other contact information.

- Complete the verification process, including providing identification documents if requested.

- Make sure your account information is accurate and up to date.

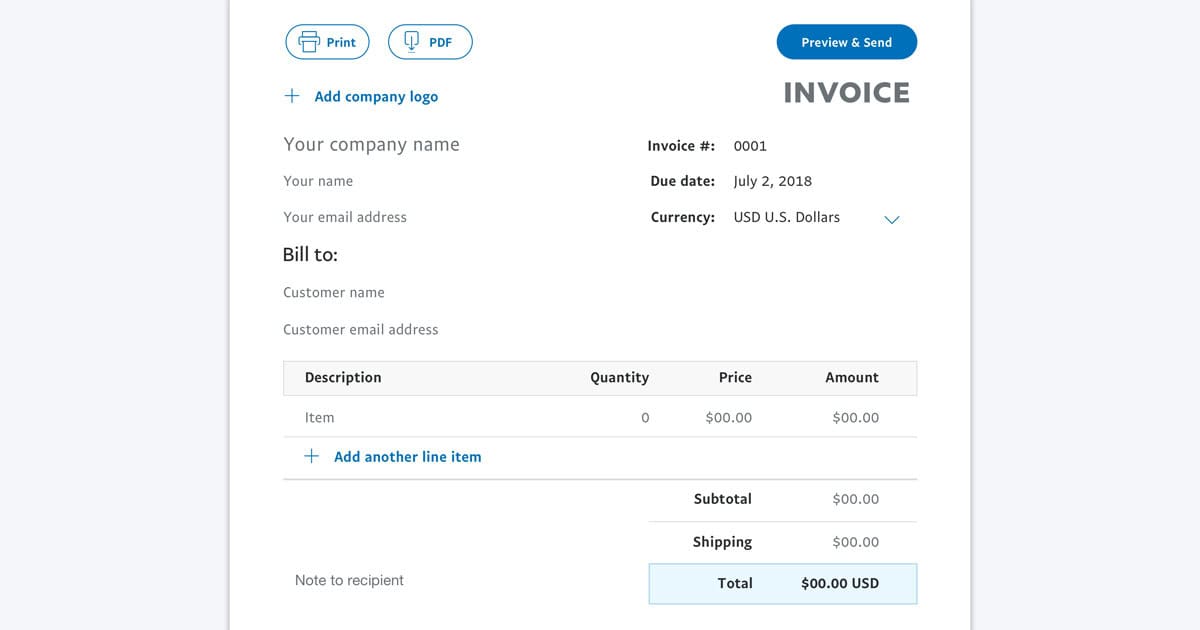

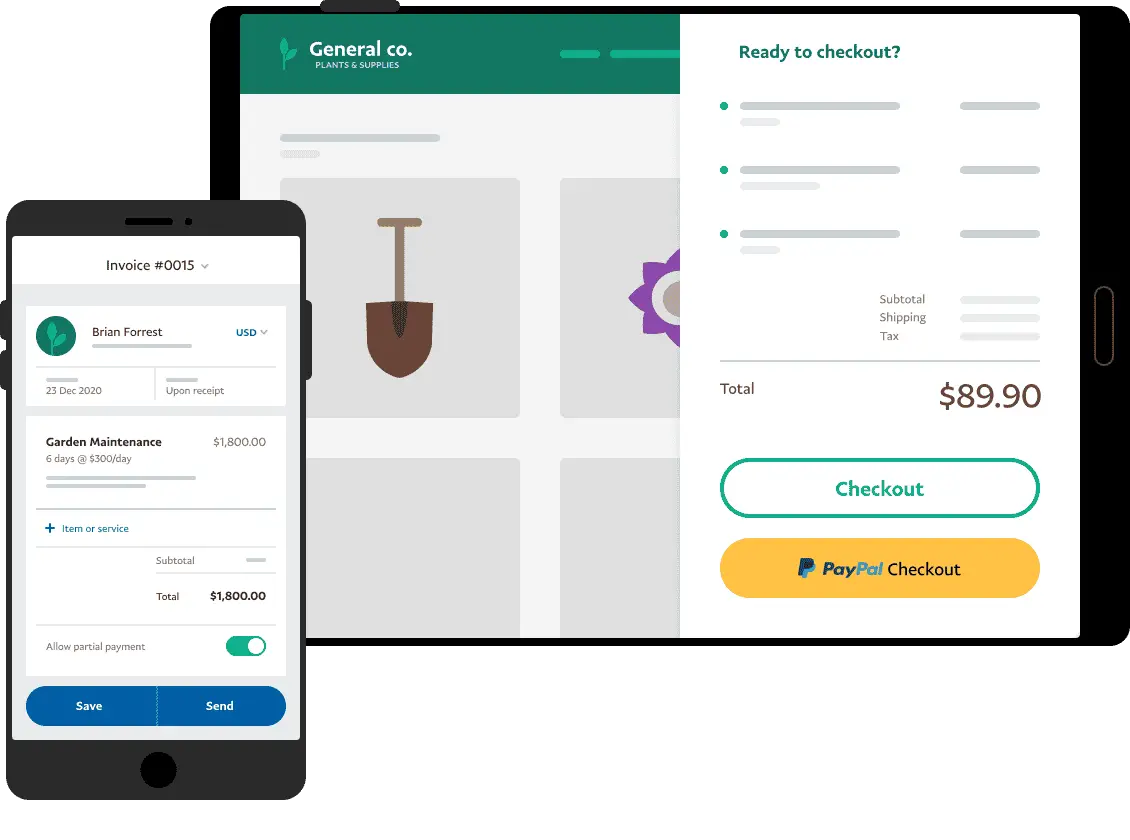

Demonstrating Proof of Product and Shipment

For sellers, providing evidence that you’ve fulfilled your obligations can lead to quicker fund release:

- Use shipping services with tracking numbers for physical items.

- Upload tracking information or receipts as proof of shipment.

- Encourage buyers to confirm receipt of the item on PayPal or leave positive feedback.

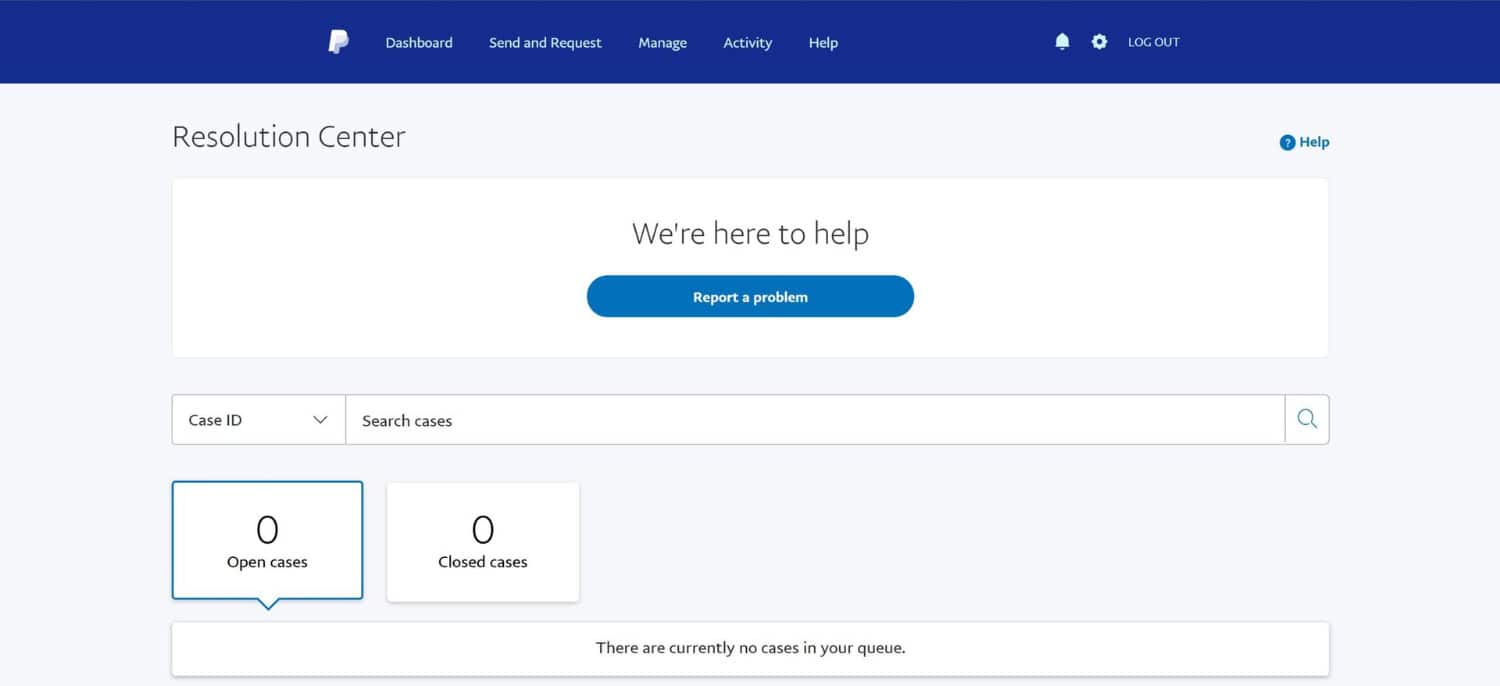

Addressing and Resolving Disputes Promptly

If a dispute arises, address it proactively to facilitate fund release:

- Respond to dispute notifications promptly and professionally.

- Provide evidence that supports your side of the dispute.

- Cooperate with PayPal’s dispute resolution process.

Maintaining Clear Communication with Customers

Open communication with buyers can prevent misunderstandings:

- Provide detailed and accurate item descriptions to set clear expectations.

- Respond to buyer inquiries and concerns promptly.

- Keep buyers informed about shipping, delivery estimates, and tracking information.

Positive Feedback and Satisfaction

Encourage positive buyer experiences to expedite fund release:

- Promptly resolve any issues or concerns buyers might have.

- Encourage buyers to leave positive feedback after successful transactions.

- Positive feedback can signal to PayPal that the transaction was satisfactory.

While these steps can improve the likelihood of fund release, PayPal’s policies and procedures can vary. Always refer to PayPal’s official documentation for the most accurate and up-to-date information. If you’re experiencing fund holds or have concerns about fund release, consider contacting PayPal’s customer support for guidance specific to your situation. So, this was how to trick paypal into releasing funds.

See also: List Of Best 7 Fake Paypal Receipt Generator In 2024

Duration of PayPal Holds

Typical Timelines for Fund Holds: PayPal holds are often for 21 days. This is a typical hold period for new sellers or accounts with limited transaction history. However, this timeline can vary based on your account history, transaction volume, and overall risk assessment. Here’s where you need to know how to trick paypal into releasing funds.

Factors Affecting the Release of Funds

Several factors can influence how long it takes for PayPal to release held funds:

- Account History: Established accounts with a positive selling history are likelier to experience shorter hold periods or have holds released more quickly.

- Transaction Volume: Higher sales volumes might trigger fund holds, especially if they deviate significantly from your typical selling patterns.

- Buyer Feedback: Positive feedback from buyers can signal to PayPal that you’re a trustworthy seller.

- Buyer Confirmation: If buyers confirm receipt of items they’ve purchased, PayPal might release funds sooner, as this guarantees successful delivery.

- Resolution of Disputes: If any disputes or claims arise, how quickly they’re resolved can impact the release of funds.

- Verification: If PayPal requires additional verification steps, such as confirming your identity or verifying your account information, this process can extend the fund hold period.

- Item Type: Transactions involving high-risk items or categories prone to disputes might experience longer hold periods as PayPal assesses the risk associated with these transactions.

Tips for Operating When Your PayPal Account is Restricted

You can follow the following tips to solve your issue-

Exploring Alternative Payment Options

If your PayPal account is restricted, you must find alternative ways to accept payments. Consider these options:

- Credit Card Payments: if you have a site or online store, you can investigate coordinating Mastercard installment doors like Stripe, Square, or Authorize. Net.

- Digital Wallets: Stages like Google Pay, Apple Pay, and Amazon Pay give clients helpful installment choices.

- Cryptocurrencies: Contingent upon your business, you could investigate tolerating cryptographic forms of money like Bitcoin, Ethereum, or others.

- Bank Transfers: Give clients your financial balance subtleties for direct bank moves or wire moves.

Benefits of Merchant Accounts

Setting up a merchant account can provide you with more control over your payment processing:

- Customization: Merchant accounts often allow for more customized checkout experiences on your website.

- Control: You have greater control over the payment process, including how payments are processed and disputes are handled.

- Customer Confidence: A merchant account can enhance your credibility and give customers a sense of security during transactions.

Opening a Separate PayPal Account

If your current PayPal account is restricted, opening a new PayPal account might be an option:

- Different Email and Bank Account: Use a different email address and bank account for the new PayPal account to avoid any issues related to the restriction.

- Start Fresh: This new account will be treated as a separate entity, so ensure you follow all guidelines and policies to prevent any issues with this account.

Remember these important points:

- Always adhere to PayPal’s terms of service and policies when operating any new or existing account.

- When exploring alternative payment options, consider transaction fees, security, and ease of integration with your existing systems.

Preventive Measures to Avoid PayPal Holds

Here are some key strategies to consider when learning how to trick paypal into releasing funds:

- Providing Excellent Customer Service:

Clear Product Descriptions: Use accurate and detailed descriptions to set customer expectations.

Prompt Customer Support: Respond quickly to customer questions and concerns, preventing potential issues from escalating.

- Open Communication with Customers:

Order Updates: Keep customers informed about their orders, shipping, and tracking.

Transparent Communication: Maintain clear communication throughout transactions.

- Avoiding Disputes and Chargebacks:

Display Policies: Clearly showcase refund and return policies to manage customer expectations.

Issue Resolution: Address customer problems promptly, reducing dispute or chargeback risks.

- Regular PayPal Monitoring:

Account Check: Regularly review PayPal for alerts, updates, or notifications.

Policy Awareness: Stay informed about any PayPal policy changes that may affect your account.

- Avoiding High-Risk Products/Services:

Risk Avoidance: Refrain from selling high-risk items prone to disputes or holds.

Awareness: Recognize product categories linked to fraud or disputes.

- Ensuring Legal Compliance:

Legal Adherence: Follow relevant laws, regulations, and industry standards in your business.

Accurate Information: Provide correct product details, adhering to age restrictions and legal requirements.

- Managing Transactions:

Gradual Growth: Increase sales gradually to avoid sudden fund holds.

Consistent Patterns: Maintain selling patterns aligned with your history.

- Tracking and Delivery Confirmation:

Shipping Assurance: Choose tracked shipping and proof of delivery to confirm successful item receipt, valuable in disputes.

- Accurate Account Details:

Information Precision: Keep PayPal details updated, including contact and banking information.

- Understanding PayPal Policies:

Policy Familiarity: Deepen knowledge of PayPal’s terms, policies, and guidelines.

Stay Informed: Stay updated on PayPal policy changes impacting your account.

Final Thoughts on Navigating PayPal Restrictions

Navigating PayPal restrictions requires a proactive and strategic approach to ensure your business operations continue smoothly. Here are some final thoughts on the matter of how to trick paypal into releasing funds:

Importance of Diversifying Payment Channels

Relying solely on one payment platform like PayPal can leave your business vulnerable to disruptions if your account gets restricted or the platform experiences issues. As another option, check out how to get a Google Play balance. Diversifying your payment channels by integrating other reputable payment gateways or options can provide you with several benefits:

- Reduces dependence on a single platform, reducing the impact of restrictions.

- Offers customers more payment choices, potentially boosting sales.

- Provides a backup plan in case one payment channel encounters issues.

Benefits of Partnering with High-Risk Merchant Account Providers

Suppose your business deals with high-risk products or services, such as certain types of digital goods, adult content, or online gambling. In that case, working with high-risk merchant account providers can be advantageous:

- High-risk merchant account providers specialize in supporting businesses with higher-risk profiles.

- They offer tailored solutions to manage risks and ensure smoother payment processing.

- These providers will likely understand your business needs and work with you to prevent unnecessary holds.

See also: 5 Best Fake Receipt Generator To Create In 2024

FAQs

Is there a PayPal bank transfer limit?

PayPal has specific cutoff points on the amount you can move to your ledger on the double. These cutoff points can change due to your record status, area, and confirmation level. For instance, in the US, there may be a daily move breaking point of around $10,000.

Can PayPal freeze your bank account?

PayPal generally cannot directly freeze your bank account. However, if there are issues, disputes, or concerns related to your PayPal account, PayPal might restrict access to your PayPal account and the funds within it. PayPal might place holds on incoming or outgoing funds, but these holds are typically related to your PayPal account activity rather than directly freezing your bank account.

How long will my PayPal account be locked?

The length for which your PayPal record may be locked can shift broadly based on the justification for the lock. If your paper is closed, it's vital to contact PayPal's client care for help and explain the purposes behind the safety and the average span.

Can I still use a limited PayPal account?

Yes, you can often use a limited PayPal account with certain restrictions. If your account is restricted, you can continue receiving funds, but you may not be able to withdraw or transfer them until the issues causing the limitation are resolved. PayPal might require you to provide additional information, documentation, etc.

Conclusion

In conclusion, grasping the significance of understanding and navigating PayPal holds is paramount for individuals and businesses. As a widely used and convenient payment platform, PayPal implements funds as protective measures to safeguard transactions, prevent fraud, and resolve disputes. We learned in the article how to trick paypal into releasing funds.

For sellers, delivering exceptional service, maintaining open communication, and adhering to best practices can foster trust, minimize disputes, and expedite fund releases. For buyers, understanding that funds ensure secure transactions is essential. At the same time, prompt communication with sellers and timely confirmation of receipt can facilitate quicker fund releases to avoid PayPal overdraft loopholes.

Generally speaking, a very educated way to deal with PayPal enables the two vendors and purchasers to explore difficulties, keep up with monetary security, and cultivate positive communications inside the computerized installment scene. Stay informed about PayPal’s approaches, guidelines, and changes, and be ready to do whatever it may take to safeguard your financial matters.