In 2022, Florida broke records for the growth in housing prices. Real estate in the southern state is getting more expensive every month. Buying apartments for expats in Florida is still relevant due to the ability of buyers to take advantage of the mortgage. At the same time, Florida Real Estate Loans for foreigners are the same as those issued to US citizens. Citizens of different countries can apply to the bank for a mortgage.

Table of Contents

Lending Terms in Florida Real Estate Loans for Foreigners

Credit organizations in the USA are presented in a wide range. Each offers different lending conditions for foreigners who want a real estate loan in Florida. And the best part is that the client can choose the most suitable option for him. You can also get funds from https://www.gofundshop.com/business-to-business-lending/ as you get a new estate.

Basic lending conditions

- The initial payment must be at least 30% of the purchase amount.

- The minimum loan amount is $100,000.

- The formal mortgage interest rate is 5%. However, for foreigners who usually do not have a credit history, it rises to 7-8% per annum.

- The term for which the loan is issued can be up to 30 years.

- Without a credit history, the bank may request collateral in the form of property.

See Also: 10 Best Sites Like Fingerhut To Shop From [Full Review]

Documents for obtaining a loan

When contacting a credit institution, remember that they will ask everyone applying for Florida Real Estate Loans for foreigners to provide a US visa and a copy of their passport.

Apart from this, banks often require several other documents, such as

- Income statement

- Tax return

- Bank statements

- A letter from an employer or an accountant (if the borrower owns an equity stake in a private firm)

See Also: What Is Google Play Credits? Everything You Need To Know

A mortgage broker

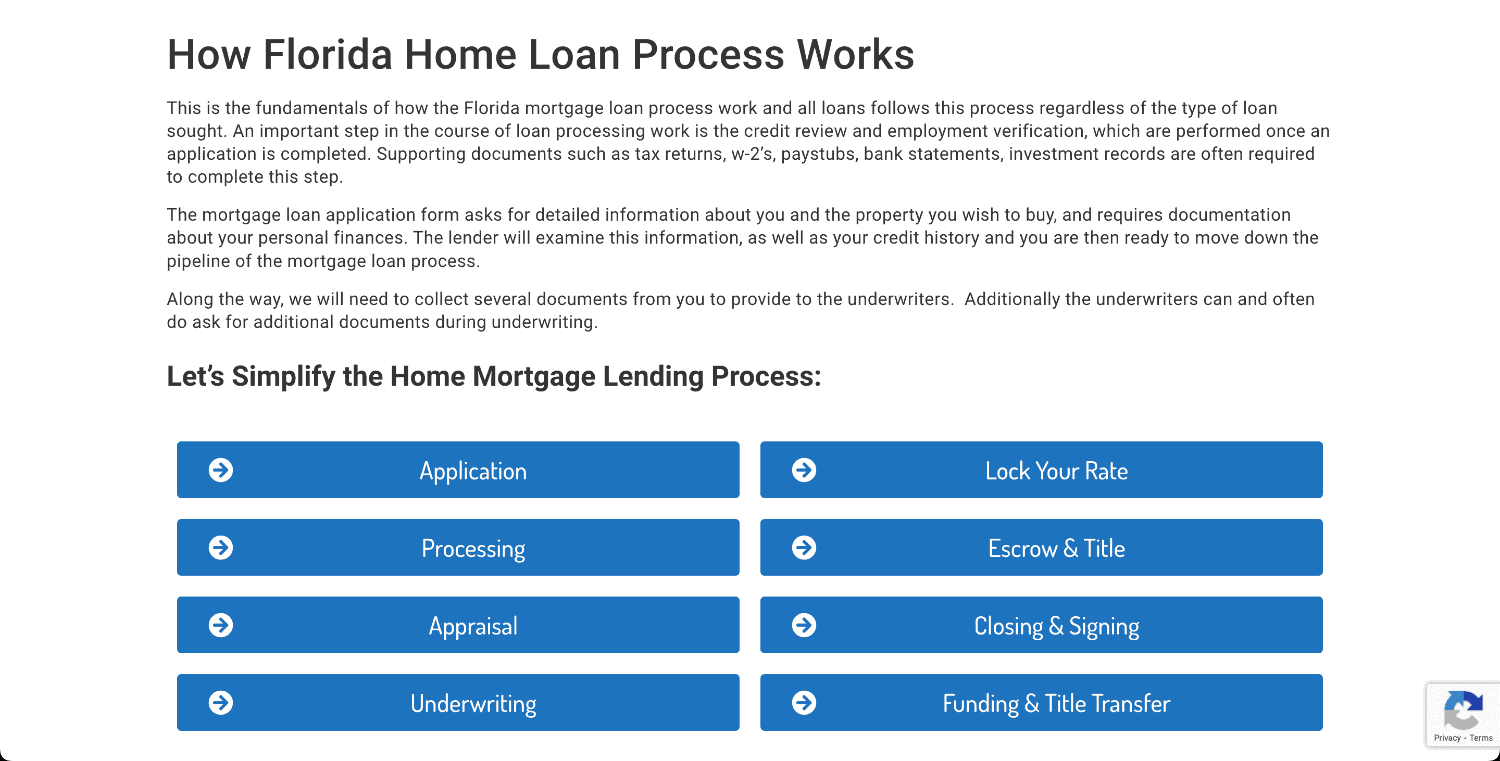

Florida has a large number of organizations that provide loans to the public. Lending programs come in different conditions, with different nuances, which you can best understand with the help of a specialist. If you want to get a loan on the most favorable terms, it is better to contact a mortgage broker.

He will analyze all the market offers and help you choose the most suitable loan with a reasonable interest rate. Based on your initial data, the specialist can calculate the loan amount and the optimal loan repayment period.

Loan confirmation

It is essential first to obtain confirmation of the mortgage terms from a credit institution, search for housing, and negotiate with the seller.

This document (pre-approval letter) must be issued in writing. It will be attached to the official purchase offer.

Comparison of the cost of real estate in Florida with other states

The value of real estate in the United States increases almost every year. In 2021, housing prices in different country regions increased by 10-12%. In 2022, the average cost of objects decreased slightly, but prices did not fall to the level of 2020.

According to American economists, in the next five years, the cost of private houses, townhouses, and apartments in the country will increase by 8-10%.

Not much will increase the value of real estate in states with poor employment. These include Missouri, New Jersey, and Michigan.

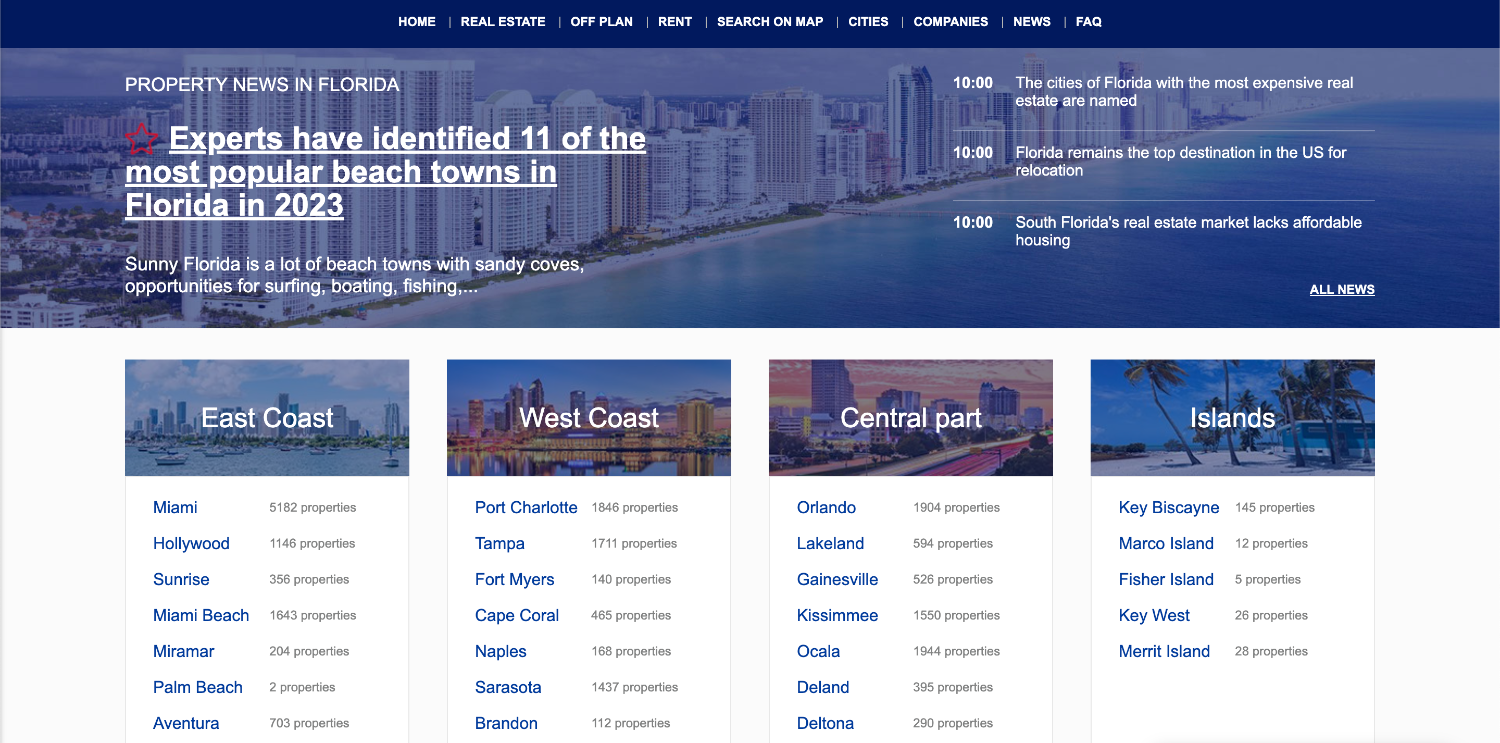

Experts expect growth in demand and housing prices in Florida. According to experts, it is better to buy houses for rent and permanent residence in the resort cities of the state: Miami Beach, Miami, Palm Beach, Orlando, and Hollywood.

The above picture is of Miami Beach, a well-liked place in Florida. Investment villas bring their owners an income of 6-7% of the cost of housing per year.

See Also: How To Retire In Thailand On A Budget With Affordable Real Estate

What is better to buy: Apartments, Townhouses, Studios, or Villas?

In Florida, objects of various types are sold: studio apartments, condominiums, townhouses, and villas. When choosing a property, it is necessary to take into account not only its price but also its location, technical characteristics, and layout. All this affects the attractiveness of the object for potential tenants and buyers.

In addition, it is essential to understand that studios, condominiums, and townhouses are located in a residential complex, the familiar territory of which is the property of all apartment owners. In this regard, in several residential complexes, apartment owners establish general rules for living. For example, in some residential complexes, it is forbidden to keep pets. Renting out the property for hourly and daily rent is impossible within certain residential complexes.

For reference, you can check out this article on Eco-Friendly Property In Turkey. Properties like this are worth investing in.

A detached house allows its owner to set the rules for living and rent out housing at his discretion: for a short-term or long-term lease.

You can also check the properties in Palm Jumeirah.

Property selection

If you decide to purchase housing in Florida with a mortgage, it is essential to determine the purchase cost in advance. You can find different real estate types in Florida, like apartments, villas, townhouses, and private houses.

Here’s a site to learn more about real estate prices in Florida. Choose prices in the search to compare different real estate options in terms of cost-quality ratio, and choose the most suitable object for yourself. You do not have to study several other sites and understand their navigation, such as Florida. Realestate has the latest offers from developers and real estate agencies.

See Also: How To Download All Tweets From A User | Top 4 Ways

Dedicated group of Computer Engineers making tech updates accessible to all. Our dream is to simplify and share tech news with everyone.